If you’re a client, the Savings Planner converts to our Smart Withdrawal Planner™ once you retire. This helps you withdraw funds without incurring greater tax liabilities. Ready to get a savings plan? Start using our free, award-winning tools. College Savings Planner. Get personalized insight into how a tax-advantaged 529 plan can help your family save for college. Use the calculator below to help your family understand future college expenses and estimate how much to save in order to stay on track with your college savings goals.

Our Savings Calculator is a free spreadsheet that is simple to use and much more powerful than most online calculators that you'll find. It will estimate the future value of your savings account with optional periodic deposits. It also includes a yearly table that lets you add specific annual deposits that may be different from year to year. You can also choose to randomize the annual interest rates within the Min/Max values you specify so you can get an idea of what a fluctuating market might do to your savings.

If you are comfortable with Excel, you can also use our Savings Calculator as a template and customize it to suit your own personal situation. We also have a 401(k) Savings Calculator designed specifically for estimating the future value of a 401(k) savings account. Try the Annuity Calculator if you are trying to figure out how much you may need at retirement.

Savings Calculator

for Excel, OpenOffice, and Google SheetsDownload

⤓ Excel⤓ Google Sheets

⤓ Excel⤓ Google SheetsOther Versions

License: Private Use (not for distribution or resale)

'No installation, no macros - just a simple spreadsheet' - by Jon Wittwer

Description

Estimate the interest earned in your savings account. Include regular monthly deposits and/or an annual deposit. This simple to use Excel spreadsheet includes a table showing the interest earned each year.

A unique feature of this calculator is the option to select a random interest rate, to simulate fluctuation in the market. Just press F9 a bunch of times to see how the graph of the balance changes.

The versions for OpenOffice and Google Spreadsheets were created using the simpler version of the calculator shown on the left. It doesn't include the random interest rate feature, but you can manually enter different rates for each year in the interest rate column.

Download the Simple Savings Calculator (.xlsx)

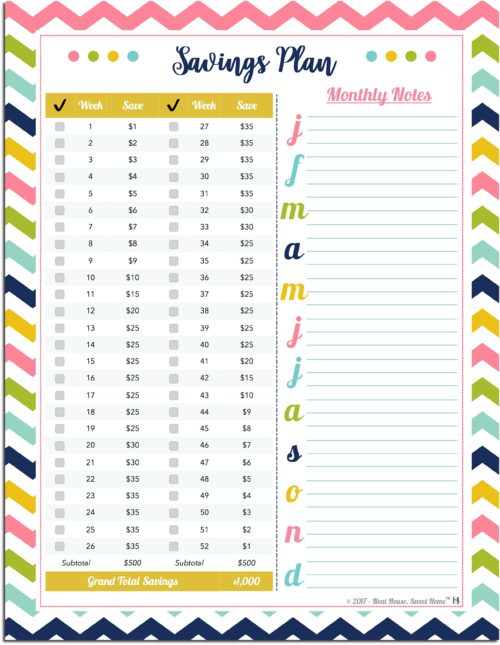

42 Effective Ways to Save MoneyHow Do I Track My Savings Goals?

Using the Savings Calculator

Example: Let's say I start with $2500 in a savings account with a 4.0% annual interest rate (perhaps a CD or money market). I plan to deposit $100 per month. I also want to deposit my tax return, but that will change from year to year. I'm pretty sure that my tax return will be at least $1000 so I enter that in the Additional Annual Investments field. The screenshot below shows that my estimated savings balance after 30 years is about $134,500.

Savings Planner

In the graph, the interest earned is the difference between the End Balance (blue line) and the Cumulative Interest (magenta line). The graph shows that until about 10 years, the majority of the balance is the cumulative amount I've invested rather than interest earned. But, by the end of the 30 years, my balance is almost twice what I put in.

Related Resources

- 401k Savings Calculator by Vertex42.com - Similar to the calculator above, but specifically for 401k calculations, where you have an employer match, increasing salary, etc.

- CAGR Formula - Explains how to calculate annual growth rate for an investment.

- Retirement Savings Calculator - www.vertex42.com - Similar to the simple savings calculator, but specifically related to retirement (graphed by age) and less flexibility in making deposits.

- Savings Bond Calculator at treasurydirect.gov - Includes the effect of federal taxes.

- Savings Calculator at www.bankrate.com

- Time Value of Money at wikipedia.org - Formulas for calculating future value of annuities.

Special Message

A New Message from Savings Plus

In an effort to reduce the potential spread of the coronavirus (COVID-19), the Savings Plus Walk in Center is now virtual. Even though our staff is working remotely, we're still here to help you with your retirement planning needs.

While Retirement Specialist worksite visits, walk-in business, and face-to-face meetings have been temporarily suspended, we're providing webinars and virtual appointments. Please visit our registration page for upcoming webinars, dates and times.

Additionally, we made it easier to schedule a virtual appointment or sign up for a webinar with your local Retirement Specialist.

The Savings Plus Solutions Center remains open 5 a.m. to 8 p.m. PT Monday – Friday at (855) 616-4776. We are here to assist you with your account, including initiating transactions, such as: exchanges, loans, unforeseeable emergencies, hardships, and other transactions.

You may fax any completed form to (877) 677-4329 or contact the Customer Solutions Center at (855) 616-4776 to obtain the form to submit by DocuSign.

Continue to access your account and process transactions online. If you are having trouble logging in, please use the Forgot Username and/or Forgot Password feature for assistance.

Savings Planner Stickers

Email us at AskSavingsPlus@nationwide.com for all other inquiries. We thank you for your patience and remain committed to providing you with secure access to your account. Please do not convey any investment trade instructions through e-mail, as it will not be honored. You may submit investment trade requests by logging in to your account or by contacting the Savings Plus Solutions Center.